Brisbane’s apartment pipeline, which suffered throughout 2018, looks to have turned a corner thanks to the improving conditions which will bring the city’s apartment supply into balance.

While property values are continuing to fall in many parts of Australia, Brisbane’s market seems to be steadily gaining pace — directly benefitting from Sydney and Melbourne’s slowdown.

During 2018 apartment values in Brisbane fell by 0.7 per cent while house values rose by a modest 0.4 per cent, an overall growth of 0.2 per cent.

According to Colliers International, declining supply in the apartment sector is now stimulating developer interest, with a number of key factors contributing to the improving market conditions.

The new potential state of an undersupplied market has created a renewed sense of urgency as the city continues to welcome approximately 25,000 new residents per year.

Queensland also benefits from the highest employment growth reaching 4.3 per cent for the 12 months to September 2018.

Related: Are One-bedders Holding Brisbane’s Apartment Market Back?

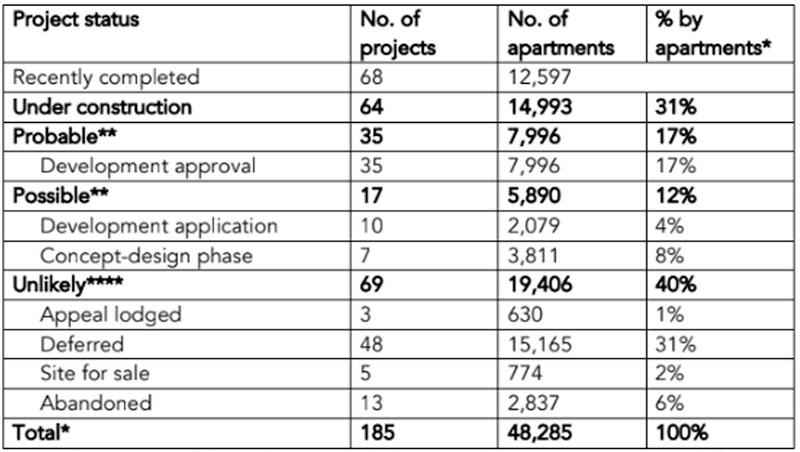

Status of new apartment projects in inner Brisbane

Image: projectadvice.com.au

At this time there are 185 new major apartment projects proposed across inner Brisbane, totalling around 48,250 apartments, however, just some 30 per cent are under construction and an addition 17 per cent are “probable” over the next two to three years.

“While there remains come uncertainty around the upcoming Federal Election and impact of the recent Banking Royal Commission, the declining supply is stimulating developers’ interest,” Colliers International executive James Forrester said.

“By the end of 2019, approximately 3,000 apartments of the current committed supply will remain under construction in the inner Brisbane.”

“This is only a fraction of what we experienced in late 2017 when there were over 15,000 apartments under construction.”

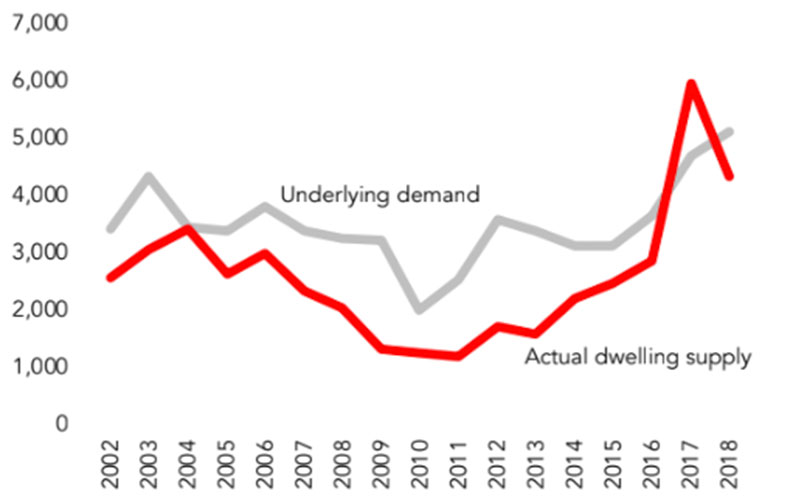

Inner Brisbane – Underlying Demand vs Actual Supply

Image: projectadvice.com.au

Brisbane, which was flooded with units 18 months ago, has since seen close to two-thirds of apartment projects planned for the city ditched or deferred.

Surprisingly, no new apartment projects launched over the last quarter, however by the end of the first half of 2019 a large number of new apartment projects are anticipated to launch across the river city.

Liveability, affordability, scale and future economic prospects has led analysts to suggest that Brisbane has the foundations to grow over the course of 2019.

Consultancy BIS Oxford Economics expects new apartment completions in Brisbane this calendar year of 5,700 — almost half of the 10,700 they peaked at in 2017.

“The site transactions volumes within 5km radius of the CBD bottomed in 2018 when over $350 million in sales was recorded, compared to $1 billion at the peak of the market in 2015.”

Brisbane’s apartment market in numbers

- Brisbane average apartment price – $831,884

- Brisbane most popular apartment configuration – two-bedroom, two-bathroom makes up 53 per cent of transactions

Looking ahead…

Corelogic is betting on another year of modest gains for Brisbane supported by interstate migration.

“Net migration rates into Brisbane should drive growth into 2019,” CoreLogic head of research Tim Lawless said.

“It’s more important as interstate migration is more likely to include buyers.”

Economic forecaster BIS Oxford Economics says Brisbane will lead the capitals, with 13 per cent property price growth predicted by 2021, although the majority of this growth will occur in 2021.

Moody’s Analytics expects apartments to outperform houses throughout greater Brisbane in 2019, as the city continues to ‘defy’ the national housing downturn.

Originally published Ted Tabet in The Urban Developer here.

See full article here.